OroraTech USA and Opterrix Partner to Integrate Real-Time Wildfire Intelligence Into Insurance Risk Platform

FOR IMMEDIATE RELEASE

First-of-its-kind integration brings space-based fire detection directly into insurer workflows.

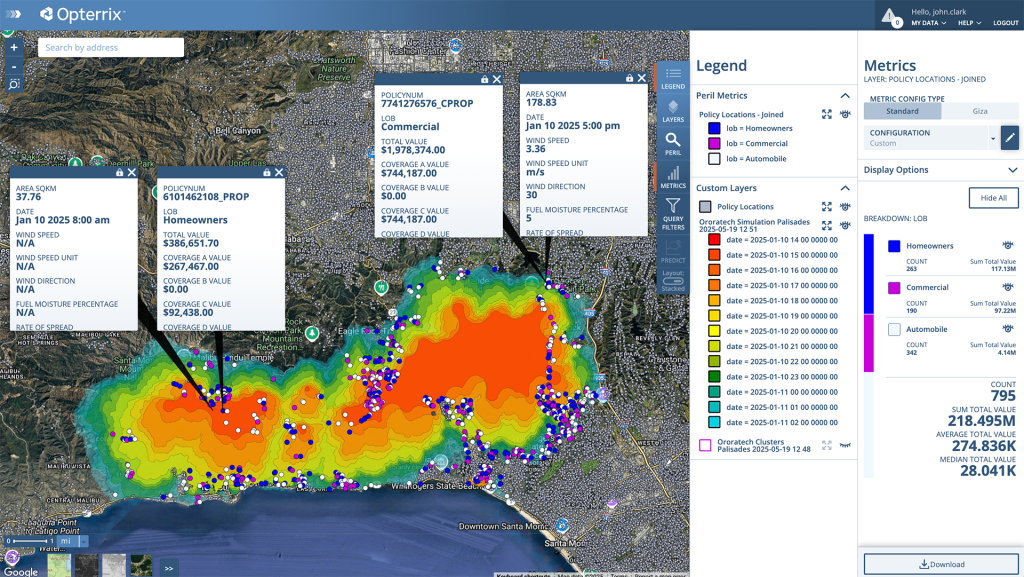

Denver, July 30th, 2025 – OroraTech USA, the leader in satellite-powered wildfire intelligence, has announced a strategic partnership with Opterrix, a next-generation risk intelligence platform built for the insurance industry. Through this collaboration, OroraTech’s real-time wildfire hotspot data and AI Fire Spread simulations will be integrated directly into Opterrix’s geospatial platform, enhancing situational awareness for insurers and enabling proactive engagement with policyholders at risk.

OroraTech’s Fire Spread product, built on advanced modeling of terrain, vegetation, and wind conditions, delivers high-resolution projections in the Opterrix platform, helping carriers understand how fire may evolve in time and space.

“Our mission is to help insurers proactively identify and manage risks before they turn into losses,” said Ben Zimmerman, CEO of Opterrix. "Wildfires are increasing in frequency and cost, and OroraTech’s low-Earth orbit satellite constellation provides us with the most timely and actionable intelligence available. Together, we’re delivering a new level of risk assessment and awareness for carriers during critical moments."

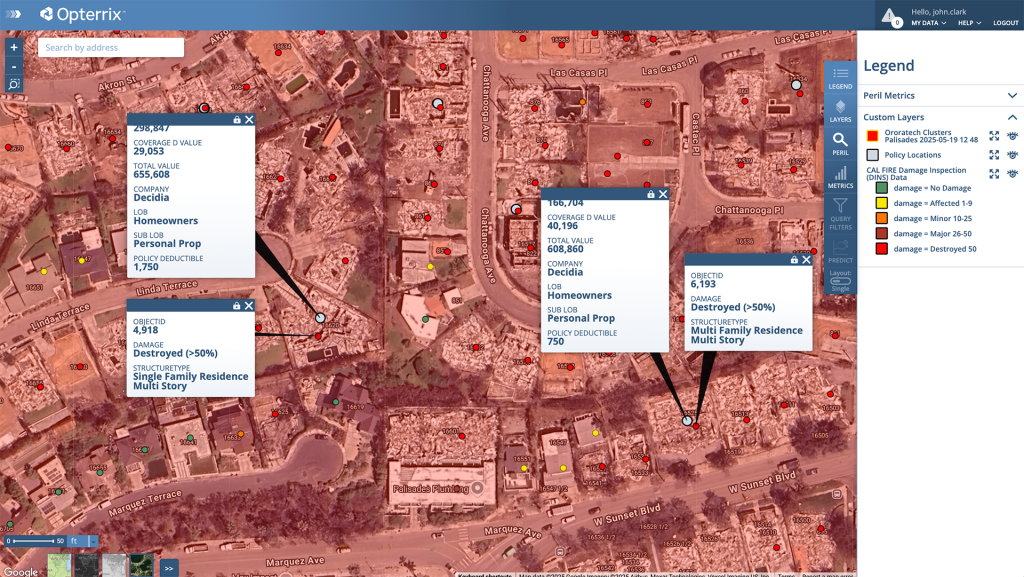

Opterrix is known for delivering real-time geospatial insights for underwriting, exposure management, and claims workflows. By integrating OroraTech’s thermal analytics and fire spread modeling, Opterrix customers will now gain street-level visibility into wildfire threats before and during an event, a key capability for mitigating loss and enhancing customer engagement.

"Wildfire has shifted from a seasonal hazard to a constant threat for both insurers and policyholders," said Thomas Gruebler, CEO of OroraTech USA. "By integrating our data into the Opterrix platform, we enable real-time risk assessment and informed decision-making. It opens our platform to insurers to strengthen wildfire intelligence across the U.S. insurance industry."

OroraTech’s thermal satellite constellation, currently delivering high-resolution wildfire data across the U.S., is capable of detecting emerging fires within minutes of ignition. When paired with Opterrix’s platform, this intelligence helps insurers know which policyholders are in danger, prioritize claims triage, and issue early warnings to customers.

The partnership aims to expand to carriers later this year, building on the insights and operational gains from this initial deployment.

About OroraTech USA

OroraTech USA is the American division of OroraTech, the global leader in space-based thermal intelligence. Through its proprietary wildfire satellite constellation and Wildfire Solution platform, OroraTech delivers real-time insights that help insurers, governments, and fire services manage risk and respond to emergencies. Headquartered in Denver, Colorado, OroraTech USA is focused on bringing breakthrough fire detection and predictive analytics to the U.S. insurance market.

About Opterrix

Opterrix™ is the most powerful risk intelligence platform in the industry, built by insurers for insurers to help insurance carriers proactively identify, quantify, and reduce avoidable losses. By leveraging advanced developments in meteorology, data science, AI, and cloud computing, Opterrix drives innovation throughout the entire insurance value chain, enabling companies to enhance underwriting accuracy, improve claims management efficiency, and optimize portfolio performance with unparalleled insights into emerging risks, resulting in fewer losses and higher profitability. Learn more at opterrix.com.

For all media inquiries, please contact:

Zach Ricklefs

Senior Communications & Content Manager

OroraTech

zach.ricklefs@ororatech.com